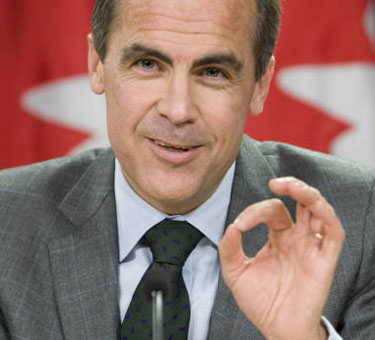

At least Bank of Canada governor Carney said something sensible about Greek referendum proposal

Nov 2nd, 2011 | By Citizen X | Category: In Brief [UPDATE NOV 3, 12 NOON ET: There are now reports that Prime Minister Papandreou will be dropping plans for a referendum on the Greek financial bailout, in response to domestic political pressures. I’ll comment further when this prospect becomes clearer. Meanwhile, I can only say that it does nothing to change my admiration for the sober and sensible position on the issue taken by Bank of Canada governor Mark Carney in Ottawa on Tuesday, as expressed in what follows.].

[UPDATE NOV 3, 12 NOON ET: There are now reports that Prime Minister Papandreou will be dropping plans for a referendum on the Greek financial bailout, in response to domestic political pressures. I’ll comment further when this prospect becomes clearer. Meanwhile, I can only say that it does nothing to change my admiration for the sober and sensible position on the issue taken by Bank of Canada governor Mark Carney in Ottawa on Tuesday, as expressed in what follows.].

I wouldn’t pretend to actually understand just what is going on in the international financial system – now or ever. But I do belong to a small partnership that invests modestly on the Toronto Stock Exchange. And some substantial enough chunk of what economic security I may or may not enjoy depends on this activity. So my interest in the so-called Greek debt crisis (fall 2011 edition) has at least some immediacy.

Whatever finally happens, to all of us, from my seat way up in the bleachers I can’t be the only one who wonders about the maturity and leadership suitability of some movers and shakers in the international financial system today. It isn’t just that their unbridled and even irrational greed had so much to do with the fall 2008 panic that launched the rest of us on our current troubled economic waters. It’s also that they often seem to react to the ups and downs of such 2008 legacies as the current Greek debt crisis with the wild emotions of 13-year-olds, feeling the first surges of sexual angst.

I have vast admiration for the past, present, and future of Greece (and especially of course its ancient past as one of the founders of modern democracy). According to the CIA World Factbook, however, Greece today has a population of 10,760,136 (76th in the global village at large – ahead of Chad and Haiti, but behind Rwanda and Kazakhstan). Its annual “Purchasing Power Parity” GDP is just over $318 billion – compared with $1,330 billion for Canada, $4,060 billion for India, $10,090 billion for China, $14,660 billion for the USA, and $14,820 billion for the European Union. (Or, if you like, the Greek economy accounts for just over 2% of the economy in the European Union at large.)

As best as I can make out, it makes very little sense to imagine that even very serious problems in a place with such demographic and economic magnitudes can wreak real havoc with even the still quite unfinished fabric of the European Union – financially or otherwise. And it doesn’t help to scream “fire in a crowded theater” every time the current emerging EU leadership runs into another not exactly surprising bump in the road, as it struggles to support a troubled smaller partner in the still quite adolescent euro zone.

Thoughts of this sort were lingering at the back of my mind, as I struggled through some 15 recent reports from the front lines on one or another aspect of the current Greek euro-bailout referendum, recently announced by Prime Minister Papandreou. And then I stumbled across something that did seem to make some sense.

It was headlined: “Greek referendum on debt deal could be a good thing, Carney says.” It reported that: “Bank of Canada governor Mark Carney says Greek plans for a referendum on its austerity measures may be a good thing … The central banker told the [Canadian House of] Commons finance committee Tuesday that plans to get Greece out of its deep debt hole will need broad democratic support if they are to work … ‘It is imperative that there is widespread support, broad democratic support for these measures because they will unfold over a period of time,’ Carney told the committee … ‘If this is a judgment of the Greek government that this is the best approach to validate that support, we fully respect that.’”

In the midst of everything else nowadays, I do sleep a little better at nights knowing that this is the man who is running the Bank of Canada – regardless of what may or may not be decided or not decided at the G20 meeting in Cannes over the next few days.

In the midst of everything else nowadays, I do sleep a little better at nights knowing that this is the man who is running the Bank of Canada – regardless of what may or may not be decided or not decided at the G20 meeting in Cannes over the next few days.

(And if you actually want to know about the 14 other reports I have just waded through, on broadly the same subject, click on “Read the rest of this page” below and/or scroll down for a list. Whatever else, the reports listed are almost all worthwhile, in one way or another. But they are also almost all a little too alarmist for my taste, as an aging and perhaps inevitably more and more skeptical follower of the alleged economic events that alter and illuminate our time.)

* * * *

* Greek Premier Pledges Vote in December on Debt Deal

* Greek financial crisis overshadows G20 meeting

* Accept bailout or go bankrupt, France and Germany warn Greece

* At noon: TSX rises with commodities

* Papandreou’s bailout strategy unnerves European leaders

* Euro zone should let Greece go

* Austerity Faces Test as Greeks Question Their Ties to Euro

* Greece’s bailout referendum gambit: grave error or glimpse of greatness?

* Greek cabinet backs Euro plan referendum

* Greek cabinet stands behind PM’s push for referendum on bailout

* Greek Prime Minister Papandreou takes a high-stakes gamble