Wednesday, 16 July 2008

UPDATED JULY 19. Even if you are just remotely interested in economics, you probably ought to be somewhat alarmed by the economic headlines haunting English-language media around the global village lately. To take just a few small examples: "Australian business hits the skids, report shows"; "Markets spooked by grim warning of recession" ; "World stocks at 21-month low as banks plunge" ; "US economic woes, supply threats drive price of crude higher" ; "Wall St. Worries Spread Into Banking Sector" ; and "Customers furious in Day 2 of IndyMac fed takeover." What’s more, as I write here in Canada remnants of a massive power failure still haunt downtown Vancouver. The old lion of the Toronto financial sector, CIBC, has "woes" that "may spark mergers." An armoured truck has been robbed in Montreal. And even in the impregnable Canadian provincial kingdom of the oil-rich tar sands, "Calgary experiences largest residential MLS sales decline in the country." So ... what does it all mean, even if you are up at the lake, on this sunny summer afternoon, driving your oil-and-gas-powered Chris-Craft very fast, trying to forget your investment portfolio — and all your other reasons for sleepless nights in the big city? UPDATED JULY 19. Even if you are just remotely interested in economics, you probably ought to be somewhat alarmed by the economic headlines haunting English-language media around the global village lately. To take just a few small examples: "Australian business hits the skids, report shows"; "Markets spooked by grim warning of recession" ; "World stocks at 21-month low as banks plunge" ; "US economic woes, supply threats drive price of crude higher" ; "Wall St. Worries Spread Into Banking Sector" ; and "Customers furious in Day 2 of IndyMac fed takeover." What’s more, as I write here in Canada remnants of a massive power failure still haunt downtown Vancouver. The old lion of the Toronto financial sector, CIBC, has "woes" that "may spark mergers." An armoured truck has been robbed in Montreal. And even in the impregnable Canadian provincial kingdom of the oil-rich tar sands, "Calgary experiences largest residential MLS sales decline in the country." So ... what does it all mean, even if you are up at the lake, on this sunny summer afternoon, driving your oil-and-gas-powered Chris-Craft very fast, trying to forget your investment portfolio — and all your other reasons for sleepless nights in the big city?

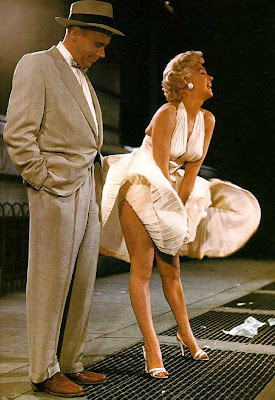

The two views in Washington, DC on Tuesday, July 15 ...

According to the New York Times: "Wall Street was focused on Washington on Tuesday [July 15, 2008], where two distinct views of the economy were being presented simultaneously. According to the New York Times: "Wall Street was focused on Washington on Tuesday [July 15, 2008], where two distinct views of the economy were being presented simultaneously.

"The chairman of the Federal Reserve, Ben S. Bernanke, cautioned that inflation may accelerate in coming months, even as economic growth remains sluggish. While he stopped short of calling a recession, Mr. Bernanke offered a strongly worded warning that ‘significant’ economic risks remained.

"The Fed chair’s gloomy assessment was reinforced by a pair of government reports released Tuesday morning, which showed that retail sales were nearly stagnant in June, even after Americans received tax rebates from the government’s stimulus plan. Meanwhile, producer prices rose more than expected, a sign of accelerating inflation.

"But President Bush, in a news conference on the economy, dismissed questions about the day’s reports and said that the economy was resilient. ‘Growth is slower than we would have liked, but it’s growth nonetheless,’ he said.

"The president’s news conference was scheduled to coincide with Mr. Bernanke’s testimony, which served to siphon media attention away from the Fed chief’s bleaker economic outlook.

"But even Mr. Bush was forced to admit that Americans were struggling. ‘The bottom line is this, we’re going through a tough time,’ he said."

(And then for yet another point of view there’s Jeffrey Simpson in the Toronto Globe and Mail, on Wednesday, July 16: "The U.S. economy is broken, but who's going to fix it?"

As Mr. Simpson explains: "Buckle up and keep it buckled, because the world economy will continue to deliver a bumpy ride ... Many are the reasons for the bumpiness, but principal among them has been, and remains, the very bad governance of the United States.")

A tough time in Canada too?

One odd thing in Canada so far this year "has been that Canada has created 132,000 jobs in the first five months of this year despite the economy contracting 0.3 per cent in the first quarter. In a similar period, the United States, with a one per cent gross domestic product growth in the first quarter, actually lost 438,000 jobs in the first six months." One odd thing in Canada so far this year "has been that Canada has created 132,000 jobs in the first five months of this year despite the economy contracting 0.3 per cent in the first quarter. In a similar period, the United States, with a one per cent gross domestic product growth in the first quarter, actually lost 438,000 jobs in the first six months."

The "most widely held explanation" for this strange behaviour, according to a Canadian Press report, "is that with commodity prices rising, the natural resources sector invested heavily in expansion that has yet to yield additional production, hence the lag with GDP."

Whatever the best ultimate explanation may be, there is also substantial agreement that the unusual Canadian jobs party of the past several months will not continue:

"Watch for signs that the economy has abruptly buckled under the weight of soaring oil prices ...One thing is clear... healthy double-digit jobs growth month after month is a thing of the past in Canada, likely for the rest of the year ... Over the second half of the year, we are anticipating that Canadian GDP growth will start to improve a bit and with that we may see some modest gains in employment, but nothing dramatic."

And then there are the (sometimes whimsical) Canadian odds and ends already noted above: massive power failure in downtown Vancouver; "woes" for the old lion of the Toronto financial sector, CIBC, that "may spark mergers"; the robbery of an armoured truck in Montreal ; and "Calgary experiences largest residential MLS sales decline in the country."

To which, an avid reader of the news will want to add such further items as: "GM tightens white-collar workforce, cuts truck output, suspends dividend" ; "Central bank raises inflation worries" ; "Financials pull North American markets lower" ; and "Energy stocks drag down TSX." Which is of course all just to say that if there is big economic trouble ahead in the United States, there will inevitably be big trouble for Canada too — even if oil and gas and other resource wealth, a somewhat tighter regulatory environment (in some respects at least), and a more sensible public health care system moderate some of the impact.

Quick notes on Australia and the UK ...

Quietly in Canada, we are more and more coming to see how Australia has helpful things to tell us (and vice-versa, as Greg Barns from Hobart, Tasmania likes to point out). Or at least we ought to be — for all manner of policy issues: social, economic, cultural, and on and on and on. Quietly in Canada, we are more and more coming to see how Australia has helpful things to tell us (and vice-versa, as Greg Barns from Hobart, Tasmania likes to point out). Or at least we ought to be — for all manner of policy issues: social, economic, cultural, and on and on and on.

On current economic themes "Australian business hits the skids" tells us that the economy down under "is braking sharply, with business reporting that soaring petrol prices and high interest rates have wiped away all positive momentum from demand ... Bankruptcies have soared to record levels." Another article — "Australia's 'food-bowl' may never recover from drought" — suggests how economic troubles nowadays can have an ecological edge. (Though surviving farmers from the North American Prairies of the 1930s can tell you this too has all happened before, as John Steinbeck tried to explain in his 1939 novel, The Grapes of Wrath, also made into a 1940 movie, which won a best director Academy Award for John Ford.)

Meanwhile on July 8 the Guardian in the UK reported that the"London stock market plunged into bear market territory today following a grim warning that the UK economy is sliding into recession and more job losses in the troubled housing market." (Sound familiar?)

On the other hand, on the same day the Times of London featured an article on how US Federal Reserve chairman "Ben Bernanke's critics misread lesson of history." Mr. Bernanke, some say, "made his name as an analyst of the Great Depression, yet his growing chorus of critics suggests that his focus on that period of unrivalled slump in modern American history has diverted him from the real threat to the United States now — a repeat not of the Great Depression but of the Great Inflation of the 1970s ... Yet the lesson from economic history is that the current inflation scare is overdone. In fact, it might already be history."

Two more upbeat assessments, from (somewhat?) unusual sources ....

As legend has it, if you ask four economists what is happening to any economy in any part of the world, you will get at least five different opinions. And in times of economic stress all economists (to say nothing of politicians) face great pressures to say something positive. As legend has it, if you ask four economists what is happening to any economy in any part of the world, you will get at least five different opinions. And in times of economic stress all economists (to say nothing of politicians) face great pressures to say something positive.

So, yes Virginia, there is some positive news out there about the economy, in North America as elsewhere these days — whether you want to hear it or not.

In discussing the recent troubling enough failure and subsequent federal takeover of the IndyMac Bank in California, e.g., Kathleen Pender of the San Francisco Chronicle has observed: "IndyMac was taken over by the Federal Deposit Insurance Corp. and reopened Monday [July 14] as IndyMac Federal Bank ... Most customers have little to worry about. Of the bank's $19 billion in deposits, all but about $1 billion will be fully covered by deposit insurance. The FDIC will repay uninsured deposits 50 cents on the dollar initially, and could pay more eventually ... The continuing stampede on IndyMac suggests that Americans either don't understand deposit insurance or have lost faith in the banking system."

And then Paul Krugman at the New York Times, who is usually critical of almost everything (and usually with good reason), has taken a rather benign view of the recent crisis in the two major US household mortgage funding institutions, Fannie Mae and Freddie Mac: "And now we’ve reached the next stage of our seemingly never-ending financial crisis. This time Fannie Mae and Freddie Mac are in the headlines, with dire warnings of imminent collapse. How worried should we be? ... Well, I’m going to take a contrarian position: the storm over these particular lenders is overblown. Fannie and Freddie probably will need a government rescue. But since it’s already clear that that rescue will take place, their problems won’t take down the economy."

* * * *

So, put all this together, and what conclusions do you get? My own instinct at the moment is to stray far away from the hallowed halls of modern economics — and into the more traditional world of history and politics, and even the ancient art of war:

In making any economic decisions you may have to over the next short while at any rate, I would humbly advise myself, attend to the wise words of Oliver Cromwell, addressing his New Model Army, just before the crucial Battle of Naseby (I believe it was) in the English Civil War, way back in the middle of the 17th century: "Put your faith in God, and keep your powder dry." (Or, as the New York Times reported as recently as July 19: "‘The open question is whether we’re in for a bad couple of years, or a bad decade,’ said Kenneth S. Rogoff, a former chief economist at the International Monetary Fund, now a professor at Harvard.") Only registered users can write comments.

Please login or register. Powered by AkoComment 1.0 beta 2!

|